GST Practitioner Course

(Law, e-filing & Case Studies)

- Become GST professional Just in 15 Days

- 35+ Hours of in-depth, on-demand learning videos

- Live Recorded Class on ZOOM by Top Mentors

- Instant access to all videos.

- Doubt Session on Weekly and Monthly Basis

- Training on Real Data with Real Clients (Practical Course)

- Downloadable Class Notes, Form and Study Material

- Support via e-mail, Telegram and Whatsapp etc.

- Full Access on Mobile, PC, Tablet and TV

Learn Trademark Law, Registration & E-Filing – A Practical Course

- Complete Understanding of Trademark Law & Process:

You’ll confidently understand Indian trademark law, classification, and the legal aspects of brand protection. - Hands-on Skill in Online Trademark Filing:

You’ll be able to independently conduct trademark searches, file TM applications, and complete e-filing through the IP India portal. - Ability to Draft Legal Documents & Objection Replies:

Gain practical skills in drafting replies to examination reports, show cause notices, and opposition documents. - Capability to Handle Real-World Trademark Cases:

Learn how to manage the full lifecycle of a trademark – filing, hearings, renewals, licensing, and rectification. - Start Your Own Trademark Filing Practice:

With practical knowledge and real templates, you’ll be ready to offer services as a freelancer, consultant, or legal service provider. - Earn a Certification:

Receive a recognized Certificate of Completion to strengthen your resume or client credibility.

- Overview of MCA V3 Portal ( Registration, Master data, Public document, Complain, Fees and more

- legal aspect & Incorporation of all Types of Company & LLP Incorporation

- Incorporation LLP Incorporation

- Filing of llp Deed

- Post Incorporation compliance ( INC-22, INC-20A, ADT-1, Share Certificate)

- Annual Compliance:

- AOC-4, MGT-7, MGT-7A, ADT-1

- DIR-3 KYC

- LLP Forms: LLP-11, LLP-8, and more

Course Description

GST Practitioner Course – Learn, Apply & Get Certified

GST monthly compliances in India are a major challenge after the introduction of the Goods and Services Tax (GST). As the GST portal / website is very complex and changing very frequently, there is an acute shortage of the GST Profession & GST Accountant.

We at BharatEduSkills is providing a comprehensive module on GST learning with full practical-based training programs on GST Laws, GST e-filing & Case Studies

Course Highlight

- 100% Practical Training

- 20+ Hours of HD Video Classes

- 15+ Real Case Studies

- 10+ Downloadable Excel Formats

- Doubt-solving support

- Certificate of Completion

- Access on Mobile + Laptop

- Language: Easy English + Hindi

What You’ll Learn

- GST Acts Rules and Regulations

- Invoicing, GST Registration

- GST Ledgers and Computation

- Invoice Management System(IMS)

- GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B

- Reconciliation of Tax Liability

- E-filing of GST Return, e-Payment

- GST Penalty, Appeals and Revisions

- Offline Tools, HSN Code, ITC, RCM

- GST Taxes, GSTR 9, Annual Return

- E-way Bill & e-invoicing

- Show Cause Notice

Why You Should Join an Income Trademark Registration& Compliance E-Filing Course

High Demand – Every company — from startups to corporates — needs someone who can manage salaries, deductions, and statutory compliance. Skilled payroll professionals are in huge demand in HR, accounts, CA firms, and consultancy sectors

100% Practical Learning

Gain hands-on experience with live trademark search, class selection, and e-filing through the official IP India portal — not just theory.

Step-by-Step Filing to Certification

Learn the entire process — from trademark search to online filing, handling objections, attending hearings, and renewing or licensing a trademark.

Career-Boosting Skills

Become job-ready for roles in IPR firms, law practices, and consultancy businesses — or start your own freelance trademark filing service.

Save Time & Avoid Mistakes

Master the right way to file trademarks, draft replies, and respond to objections — and avoid common errors that lead to rejections.

Perfect for Beginners & Professionals

Whether you’re a law student, advocate, business consultant, or entrepreneur — this course is designed to make you confident in real-world trademark compliance.

Certificate of Completion

Earn a valuable certificate that adds credibility to your profile and showcases your skills to clients or employers.

What You will Get

35+ Hours in Depth on Demand video

20 + Practice Set Downloadable

Live Recorded Class on Zoom

Notes, Form and Study Material

Course (Completion Certificate)

Training on Real Data with Real Clients

1 Yr complete Access on Mobile/PC/Tablet

Doubt Session weekly and monthly basic

Free Monthly News letter on recent changes

300 + MCQ

Case studies & AAR

Unlimited Views

Downloadable Class Notes

Complete Course Module

Module 1:

Understanding of Important Laws

Understanding of provisions of laws is first and an important to become an expert in GST. In this Module, You are going to learn, What is the legal provisions and important section in the GST system in India?, Portal Overview and the Deep Knowledge of GST filing, including its Concept, Scope, and Objectives. Also, study the legal framework of GST, including the GST Act, rules, and regulations governing its implementation

Module 2:

GST Compliance, Procedures & e-filing

As to get a good salary, an accountant must have good knowledge of GST e-filing(All Type of work). In this module, you will also learn, how to handle GST online government Portal. You also learn practical e-filing, where you will learn about GST Registration, Offline Tools, how to pay various challan, how to prepare returns like GSTR-1, GSTR 3B, GSTR-4, GSTR-7, GSTR-9, Annual filing, Invoice Management System (IMS), 2A & 2B, e-Way bill, e-invoice, TDS, TCS and many others

Module 3:

Case Studies

Course Curriculum

Understanding of GST Laws & rules

- Introduction of GST, Taxable and Non Taxable Items, Registration.

- Taxable Items, Invoice, Composition Scheme, ITC, e Way Bill, RCM, Time and Place Supply.

- Computation of GST, CGST, IGST, SGST, UTGST, Input Tax Credit, Returns and Book of Account.

- ITC, Audit, Inspection, Demand, Recovery, Penalties, GST on Import and Exports.

GST Practicles

- What is GST, Portal Overview, Gst Registration Process, Services, IGST, CGST, SGST, UTGST, CESS.

- GST Portal Overview, Login, GSTR-1, Sales Record, Add Records, Nil Return,

- E-invoice and e-Way bill System and Form filing through online Portal.

- Offline Tool Upload and Download.

- GSTR-2, GSTR-2A, GSTR-2B, Purchase Record, File Return, ITC, Auto Drafted ITC Statement.

- GSTR-3B, Monthly Returns.

- ITC, RCM, Credit Notes.

- Annual Return for Normal Taxpayers, GSTR 9 Return filing, GSTR 9C Audit Reports, Reconciliation Statement.

- Introduction of GST, GST Registration, HSN Number, How to Search GST and Law.

- Portal Overview Login, Certificate, Digital Signature, e-Invoice, Returns GSTR1 GSTR3B.

- GSTR1 How to Record and Generate Sales Invoice, Edit Records, Within and Outside State.

- E-Waybill System and e - Invoicing.

- GST B2C, e-Invoice, LARGE INVOICE, Nil Rated Supplies, Tax Liability, Adjustment of Advanced.

- GSTR1, Sales Records, TCS, Supplies Made Though ECO U/s 9(5), Credit Debit Notes.

- GSTR1 Amended Records, 9A, B2B Export Invoice, Large invoice, HSN Summery, B2CLA.

- GSTR-1, HSN, Sale Record, Offline Tools, Documents, Credit Note, Offline Records, JSON.

- GSTR-1 OFFLINE TOOL Uses (Download, work and Updated), B2B, B2C.

- GSTR-1 Offline Tools, HSN, GSTR-2 (Purchase).

- GSTR - 2, Purchase, Reconciliation, GSTR 2A, GSTR 2B, B2B, ITC, RCM.

- GSTR - 3B, Summary of Sales and Purchase, ITC.

- ITC Reclaimed, Reversed, 16(2), Ledgers, GST Summary.

- Challan, Late Return Filing, Charges, Demand, Payment Method, GSTR 9 Annual Return.

- Doubt Session 1

- Doubt Session 2

GST Case Studies & Show Cause Notice

- Show Cause Notice for Cancellation of GST for Not filing returns.

- Show Cause Notice for Short Liability declared between GSTR1 & GSTR-3B.

- Show cause Notice for Difference between GST2A/2B & GSTR 3B.

- Show Cause Notice for Mismatch declaration in GSTR-1 and E-way bill portal.

- Show Cause Notice for the Input tax credit is wrongly availed or utilised.

- Show Cause Notice for Inconsistent declaration in GSTR-1 and e-way bill portal.

About Course Faculty

CMA Gaurav Kumar

Qualification: FCMA, B.COM (H)

Experience: 18 Yrs.

Training session: 21000+

Student Trained: 15000+

A fellow member of The Institute of Cost accountant of India & a Hons commerce graduate from University of Delhi, has an overall experience of near about two decades in ROC, Management accountancy, Cost accountancy, Indirect tax, Trademark & managing various statutory compliances and audit. He has taken more than twenty-one thousands training session on various topic on GST, Income tax, Tds, Payroll, Roc compliances, Cost audit, Trademark and advance Microsoft excel, With the knowledge and practical skill set of CMA GAURAV KUMAR, more than 15000+ students get benefit on learning of practical aspect of Cost Accounting, Goods & Service tax, Roc compliances, Trademark and MIS reporting. Apart from training, he is also a Cost & Indirect tax consultant in New Delhi, India where he is giving his service to more than 250 companies across India.

Mr. Punit Singh

Qualification: B.COM

Experience: 20 Yrs.

Training session: 1045+

Student Trained: 11560+

Mr. Punit Singh is a Hons commerce graduate. He has an overall experience of near about two decade 20+ years in Financial Accounting, Bookkeeping, Taxation, Auditing, and Finalizing the Balance sheet. He has taken more than 1045+ training sessions on various topics on Financial Accounting, Bookkeeping, Taxation, Auditing, and Finalizing the Balance sheet. I have experience of every accounting software like Tally Prime, Busy, QuickBooks, Wave.

Mrs. Amrita Rai

Qualification: (CA Finalist, LLB, B.Com (A&F),MBA, ACCA)

Experience: 11 Yrs.

Training session: 1200+

Student Trained: 6524+

Mrs. Amrita Rai is a CA Finalist, LLB, B.Com (A&F), MBA, ACCA. She has an overall experience of near about one decade 11+ years in Accounting and Taxation Corporate laws, Direct taxes and GST, B.Com. / CA / CS / LLB / LLM. She has taken more than 1158+ training sessions on various topics on Accounts, Corporate laws, Direct taxes and GST, B.Com. / CA / CS / LLB / LLM.

Offer

Learning Guaranteed Else 100% Money Back

16 Module with 50+ Hours In-Depth, On-Demand Updated Step-by-Step Learning video by Industry Expert Trainer – Now become a Trademark Practitioner in Just 20 Days

Trusted by Many Student's Reviews

Be Certified upon Successful Course Completion.

Be Certified upon successful course completion by Bharat Eduskills Private Limited and enhance your professional credibility. It represents dedication, knowledge, and expertise in Payroll filing.

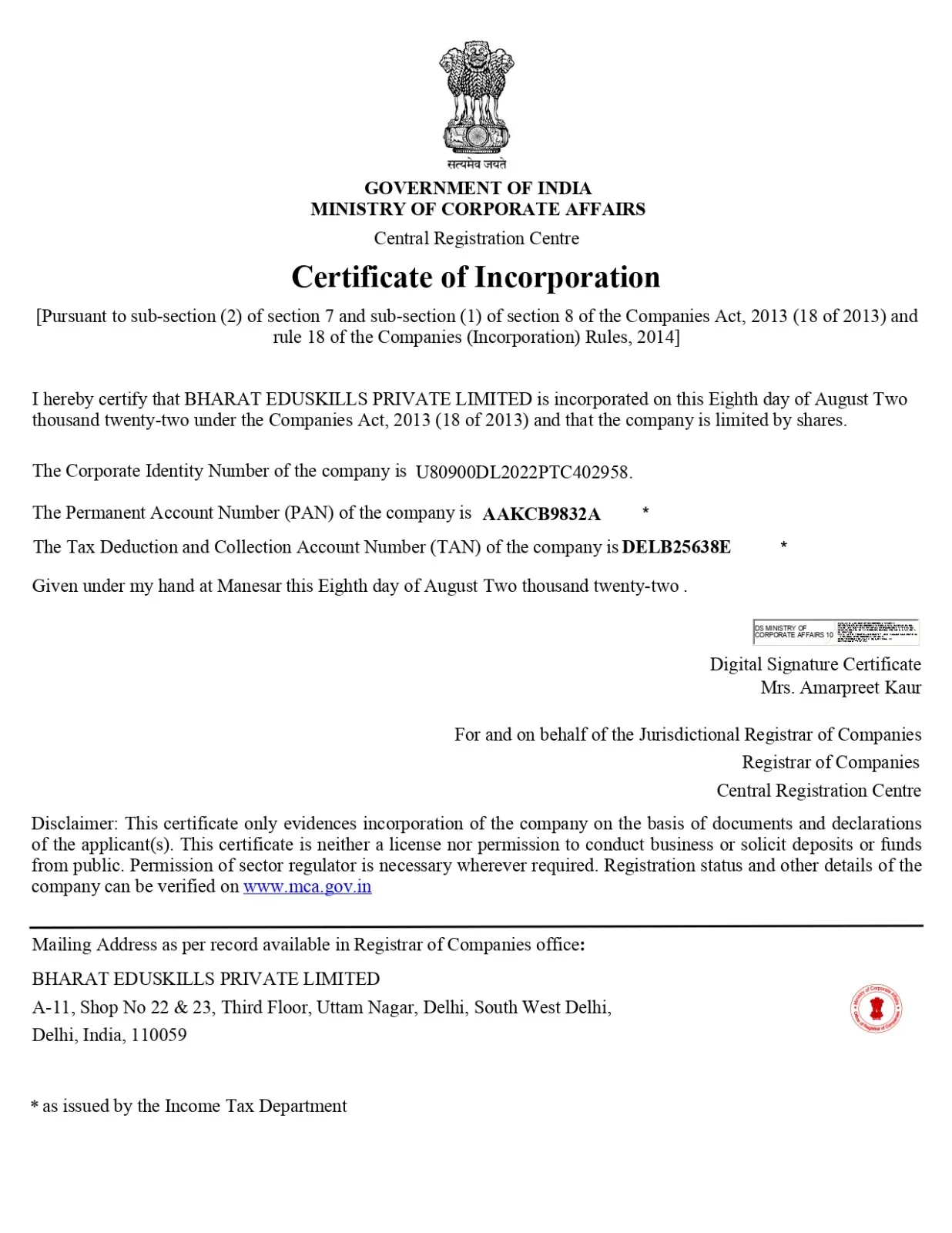

Company Certificates

Frequently Asked Questions

Anyone, including Students, Accountants, Business Owners, and Professionals looking to enhance their GST knowledge, can Enroll.

Yes, the course covers GST concepts from basics to advanced levels, making it ideal for beginners as well as professionals.

Yes, upon successful completion, you will receive a Certified GST Expert certificate.

Yes, our GST Practical Course includes hands-on training with GST filing, case studies, and real-world applications.

This course is conducted fully online, allowing you to learn at your own pace from anywhere.

We offer a 100% money-back guarantee if you are not satisfied after completing the course.

From Management Helpdesk

Bharat eduskills private limited a 11-Year-old premier Institute run and managed by AVG Management Services Private Limited that serving education and Practical training to students all over India since 2014. Bharat eduskills private limited is an effort to create abilities in job seeking students, after passing 10th, 10+2, undergraduate and fresh graduates, Postgraduate and Professional Choosing the right career program is one of the most important decisions that you will make in your life. In the highly competitive global environment, the role of communication and public speaking will be crucial for aspirants to flourish in the 21st century. Keeping the future global business competencies in mind, has formulated a unique Scheme of Education and Training. The new scheme has been upgraded, revised and refined keeping in mind the Indian & global requirements, aligned with Practical Training of the subjects, which will prepare and groom the new professionals to match the future requirements.

Price 9999. Today Offer Just ₹ 999 Only